Whatever You Need to Learn About Cash Loan and the Benefits of a Payday Advance

Cash loan and payday advance loan are preferred financial devices for those dealing with instant money lacks. These options supply fast accessibility to funds, however they additionally feature considerable threats. Comprehending their ramifications and mechanics is crucial for anyone taking into consideration these paths. Nevertheless, prior to deciding, it is crucial to check out both the advantages and potential mistakes. What choices might better offer long-term monetary health and wellness?

What Is a Cash loan?

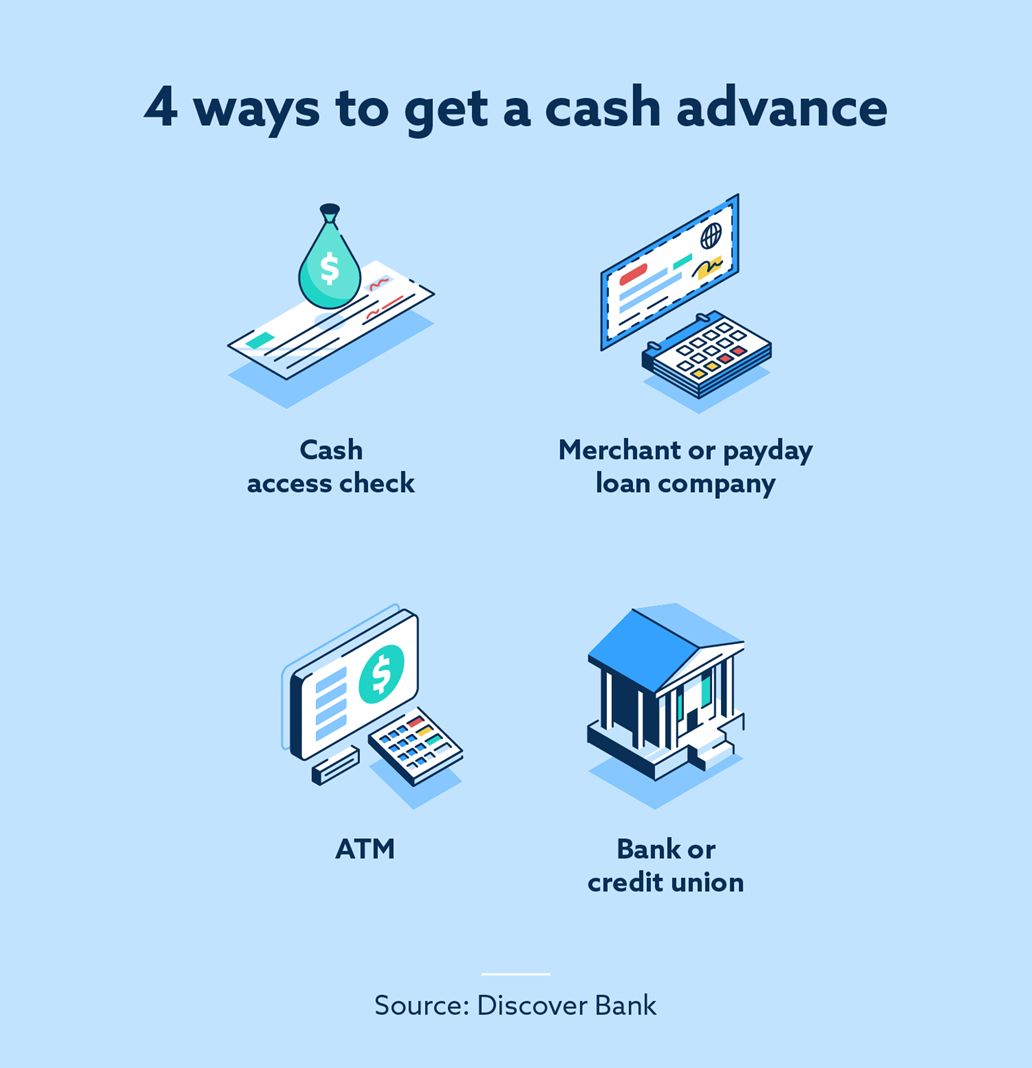

A cash loan is a short-term loan that allows individuals to access funds swiftly, usually via credit cards or personal car loans. This financial device supplies prompt liquidity when unexpected expenditures occur, such as medical expenses or automobile repair services. Unlike typical financings, cash loan typically call for minimal paperwork, allowing faster approval and dispensation. They can be acquired at Atm machines or with bank card companies, making them accessible in urgent circumstances.

Debtors need to be aware that cash advances commonly come with greater passion prices compared to routine credit history card acquisitions. Additionally, costs may use, which can build up quickly if the equilibrium is not settled promptly. Consequently, while cash loan can be a practical solution for urgent cash demands, people need to thoroughly consider their economic circumstance to stay clear of potential mistakes related to high costs and settlement difficulties.

Understanding Payday Loans

Payday advance are short-term monetary items designed to provide fast cash money to debtors in demand. These loans generally require repayment by the following cash advance and include particular qualification criteria that prospective customers have to satisfy. Recognizing exactly how payday advance loans job and their requirements is necessary for any individual considering this kind of financial aid.

Definition of Cash Advance Loans

How They Function

While exploring the auto mechanics of cash advance, it ends up being clear that these financial products operate a simple facility. Customers looking for quick cash money can acquire a temporary financing, generally due on their next income. The process generally includes a basic application, where the debtor provides proof of earnings and recognition. Upon authorization, the loan provider supplies the car loan amount, frequently come with by a charge based on the obtained sum. Settlement happens immediately when the debtor obtains their paycheck, with the loan provider subtracting the owed amount straight from their savings account. This benefit allures to those facing unforeseen costs. Debtors should be watchful, as high rate of interest rates can lead to a cycle of debt if not handled thoroughly.

Qualification Requirements Discussed

To receive a payday advance, consumers need to meet details eligibility requirements that loan providers generally call for. First, applicants need to be at the very least 18 years of ages and have a valid government-issued identification. A consistent resource of revenue is also necessary, as lending institutions need guarantee that borrowers can repay the finance. This revenue can come from work, social safety, or other regular sources. Additionally, consumers need to have an active monitoring account, which enables the straight deposit of funds and automated withdrawal for settlement. While credit checks might vary by lending institution, several cash advance carriers do not prioritize credit history, focusing instead on revenue stability and payment ability. Comprehending these demands assists candidates browse the cash advance process efficiently.

How Cash Loan and Cash Advance Loans Work

Money advancements and payday advance loan operate as quick economic solutions created to address instant capital demands. Normally, individuals make an application for these financings through financial establishments or on-line platforms, submitting fundamental individual and monetary info. Authorization procedures are typically quick, occasionally giving funds within hours.

A cash loan allows debtors to access a part of their charge card limit as money. The debtor sustains interest and charges, frequently at a higher price than standard purchases, which collects till repayment.

On the other hand, payday advance are temporary loans, commonly due on the consumer's following cash advance. The amount borrowed is usually little, meant to cover unanticipated expenditures up until the following paycheck. Borrowers accept settle the funding quantity plus charges on the specified due date. Both options are normally meant for emergency use, stressing the relevance of understanding the terms and prospective ramifications prior to devoting to either financial item.

Benefits of Using Cash Money Advancements and Payday Loans

Accessing cash advancements and cash advance can offer several advantages for people dealing with urgent monetary requirements. One crucial benefit is the rate of authorization and funding; debtors often receive funds within a day, minimizing instant monetary anxiety. These finances usually need very little documentation, making them available also for those with less-than-perfect credit rating. The application process is generally straightforward, enabling individuals to secure funds without considerable documentation or prolonged waiting durations.

In addition, cash loan and payday advance can aid cover unforeseen expenses, such as medical expenses or cars and truck repair services, stopping the demand for pricey hold-ups. Many lending institutions likewise provide flexible payment choices, enabling borrowers to handle their funds better. Inevitably, these monetary items can work as a crucial lifeline, guaranteeing that people can navigate via tough situations with loved one ease and confidence.

Vital Considerations Before Taking a Loan

Before securing a cash money development or payday advance loan, it is necessary to comprehend the funding conditions. Cash Loans. Furthermore, people should evaluate their ability to pay back the Cash Advance car loan to prevent possible economic stress. Exploring different options might likewise offer much more beneficial options to their monetary requirements

Understand Funding Terms

Recognizing finance terms is essential for any person taking into consideration a cash advancement or payday advance loan, as these agreements commonly consist of intricate problems that can greatly influence settlement. Consumers should pay very close attention to the rates of interest, which can differ considerably between lenders and influence the overall amount owed. On top of that, understanding the fees connected with the loan is crucial, as surprise costs can intensify the expense all of a sudden. Financing duration is another crucial element; recognizing when settlements are due helps stay clear of penalties. Quality on the consequences of defaulting can protect against future monetary strain. By extensively understanding these terms, borrowers can make enlightened choices and navigate the loaning landscape more effectively. Awareness of such details is essential to effective loaning.

Examine Payment Ability

Evaluating repayment capability is crucial for anybody thinking about a cash loan or cash advance. Consumers need to analyze their present economic situation, including revenue, costs, and any kind of present financial obligations. Understanding month-to-month capital allows individuals to identify if they can conveniently fulfill repayment terms without incurring extra economic stress. It is likewise essential to variable in unanticipated expenses that might occur throughout the funding duration. By reasonably estimating the capacity to settle, borrowers can stay clear of coming under a cycle of financial obligation or default. Additionally, thinking about potential modifications in employment or various other earnings resources is vital. Inevitably, a comprehensive analysis of repayment ability aids borrowers make informed choices and pick funding choices that straighten with their economic stability.

Discover Alternatives First

While cash advances and cash advance fundings might seem like quick solutions to economic requirements, exploring choices is important for debtors seeking sustainable options. Cash Loans. Prior to devoting to high-interest fundings, people must consider various options that may relieve their financial strain. Alternatives such as bargaining settlement plans with creditors, seeking aid from regional charities, or using neighborhood sources can provide prompt relief without building up financial debt. In addition, obtaining from buddies or family may provide much more desirable terms. For those with a secure revenue, using for a personal finance from a cooperative credit union or bank could yield lower rate of interest. Ultimately, exploring these alternatives can lead to much better monetary end results and stay clear of the pitfalls related to payday advance and cash loan

Alternatives to Cash Loan and Cash Advance Loans

When individuals discover themselves in need of fast cash however wish to stay clear of the high costs connected with cash advances and payday advance loan, numerous alternatives might supply more workable choices. One popular selection is an individual financing from a cooperative credit union or financial institution, which normally supplies lower rates of interest and even more flexible payment terms. An additional choice is borrowing from good friends or household, which can remove interest totally and give a more forgiving repayment routine.

Additionally, people may take into consideration a side job or freelance job to produce added revenue, permitting them to satisfy their economic demands without resorting to high-cost fundings. Offering extra things can likewise offer a fast cash money influx. Some might check out community assistance programs or neighborhood charities that provide financial assistance for those in demand. These choices can often provide a safer and extra lasting way to deal with temporary monetary emergency situations.

Often Asked Concerns

Are Money Advancements and Payday Loans the Very Same Thing?

Cash loan and payday advance loan are not the exact same. Cash loan usually entail loaning against a charge card restriction, while payday advance loan are temporary fundings based on earnings, commonly with greater rate of interest prices and fees.

Just How Quickly Can I Obtain Funds From a Cash Advance?

Funds from a payday advance can generally be obtained within one service day, although some lenders might offer same-day financing. The specific timing commonly relies on the loan provider's policies and the applicant's financial establishment.

What Takes place if I Can't Settle My Payday Advance Loan on Time?

If a debtor can not repay a payday advance on schedule, they might incur added fees, face raised passion prices, and possibly harm their credit report. Lenders might additionally go after collections, affecting the borrower's financial stability.

Can I Obtain a Cash Loan With Bad Credit Score?

Yes, people with poor credit history can still acquire a cash money advancement. They may deal with higher costs or passion rates, and loan providers might impose more stringent terms due to perceived danger linked with their credit rating history.

Exist Any Fees Connected With Cash Loan?

Yes, cash advances normally involve various costs, which might consist of transaction fees, rate of interest costs, and extra service fees. These prices can substantially raise the complete quantity owed otherwise managed thoroughly by the consumer.

A money advance is a short-term financing that permits individuals to gain access to funds promptly, normally via credit score cards or personal fundings. These lendings are generally little, short-duration loans that customers are expected to pay off by their following cash advance. In contrast, payday loans are temporary financings, commonly due on the consumer's next payday. Before taking out a cash money breakthrough or cash advance funding, it is essential to recognize the financing terms and problems. Recognizing lending terms is crucial for any individual thinking about a cash money advance or cash advance car loan, as these agreements usually consist of intricate problems that can significantly influence settlement.